Only domiciles having immovable property eligible for participation in bid process

JAMMU, FEBRUARY 22: Additional Chief Secretary, Finance, Atal Dulloo, today reiterated that the new excise policy would ensure that only single vend is secured by a bidder whose eligibility has been capped to the domiciles of Jammu and Kashmir only.

ACS, while announcing the ‘Excise Policy 2022-23′ here at Excise Taxation Complex, maintained that the policy would bring greater social consciousness and awareness about harmful effects of liquor consumption and drug abuse.

He further said that it would also put an effective check on the menace of bootlegging and smuggling of all narcotic drugs in J&K from neighboring states and UTs.

It was informed that besides making quality liquor available to consumers this policy would encourage transition from high to low alcoholic content beverages to safeguard the health of consumers.

Regarding changes to ensure that no evasion of rules occurs and the vends go under auction in a transparent manner, it was apprised that the e-auction portal would be governed by J&K bank as a 3rd party nodal agency.

The policy has added features of encouraging local production by exempting export duty on all kinds of liquor for the policy year 2022-23. It would also fulfill the need of providing quality drink to consumers in unserved/underserved areas as some new vends have been proposed in the policy.

The department has made certain amendments in the previous policy by increasing Earnest Money Deposit (EMD) from Rs 5 lakh to Rs 7 lakh and Minimum Guaranteed Revenue (MGR) by 10 per cent.

Moreover, the bidder should be having good character without being convicted for any non-bailable offense. It has also been added that the bidder should have immovable property equivalent to 100% of bid amount in the UT and should not be defaulter of taxes department under different acts governing J&K.

The policy has also framed timelines under which different activities of bidding would be carried out and a bidder has to deposit the bid amount in a period of 10 working days. The successful bidder would also be given the license after receiving clearance from the concerned District Magistrate in a period of 15 days only.

On the occasion, Commissioner Excise, K S Chib; Commissioner, Sales Tax, Showkat Aijaz Bhat; Director General Codes, SL Pandita and other officers and officials of the twin departments were present.

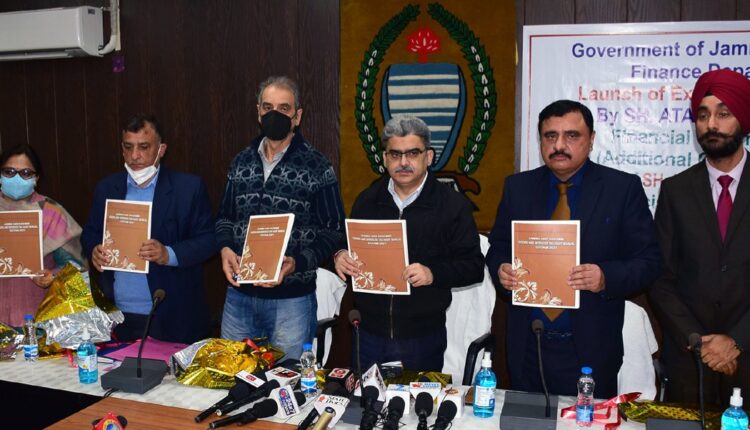

Meanwhile, Atal Dulloo in presence of Commissioner, State Taxes, Showkat Aijaz Bhat, released GST Audit Manual during a book release function held at Excise and Taxation Complex, Panamachowk, Jammu.

ACS emphasized that the Goods and Service Tax is a trust base regime wherein the taxpayers are required to self assess their tax liabilities and file the return. To ensure whether the taxpayer has made correct declaration regarding his liability the concept of audit plays a pivotal role in determining the same, he added.

The process of audit involves examination of records, returns and other documents required to be maintained by the registered person.

While appreciating this initiative of the State Taxes Department, Dulloo highlighted that the manual would act as a comprehensive guide to conduct audit under Goods and Services Tax Act and will also help in equipping the officers with requisite skills in audit and scrutiny.

Showkat Aijaz Bhat highlighted that the guidelines provided in the manual are intended to ensure that the audit of taxpayer is carried out in a professional and efficient manner while adhering to the stipulated principles and policies as per the best international practices.

The function was also attended by Director (Codes) Finance Department, J&K, along with Additional Commissioner, State Taxes (Administration and Enforcement) Jammu and other officers of the department.